Weeks of uncertainty that pressed on Philippine financial markets gave way to rallies in stocks and the peso as investors jumped back in after the election of Rodrigo Duterte as president.

The Philippine Stock Exchange Index surged 2.6 percent, the most since Jan. 27, while the peso strengthened versus all of its 10 Asian peers as Duterte sought to ease investor concerns after claiming victory. The tough-talking mayor of Davao city said on Monday it was time to start a process of “healing,” and named potential cabinet members.

“It’s a relief rally,” said John Padilla, who helps manage the equivalent of about $7.84 billion at Metropolitan Bank & Trust Co., nation’s third-largest money manager. “Investors are relieved that the process has been peaceful and free of widespread cheating, and that the main protagonist has a commanding lead, paving for a peaceful transition.”

With 90 percent of polling stations reporting, Duterte had secured 39 percent of ballots in an election held amid sporadic violence and delays. He now faces the challenge of sustaining investor confidence that helped fuel economic growth that averaged more than 6 percent under outgoing President Benigno Aquino, while managing the expectations of an electorate swayed by populist pledges such as taming crime within six months.

Uncertainty about his economic plans and lack of policy-making experience had sent investors to the sidelines in the weeks before the election. As of last Friday, Philippine shares tumbled more than 5 percent from a March high when the Southeast Asian nation entered a bull market, erasing most of its gains for 2016. The peso weakened 1.8 percent in April in the worst performance in Asia.

“Past days have been virulent, I’d like to reach my hand to my opponents,” Duterte, 71, said in a briefing in Davao City after Monday’s voting. “Let’s begin healing now.”

The Philippine Stock Exchange Index rose for the first time in three trading sessions. Local markets were shut Monday. The peso rose 0.7 percent to 46.75 per dollar at the close in Manila, after initially dropping as much as 0.3 percent from Friday’s close, prices from the Bankers Association of the Philippines show. The country’s dollar-denominated bonds due in 2041 advanced for a fourth day, sending the yield down three basis points to 3.26 percent, according to Bloomberg Bond Trader prices.

“With most of the uncertainty priced in and Duterte making positive comments so far, that should help soothe investor sentiment," wrote Khoon Goh, a senior foreign-exchange strategist at Australia & New Zealand Banking Group Ltd. in Singapore. “The extent of the uncertainty premium that had been priced in over the past month seemed excessive.”

Duterte told reporters on Monday he may appoint Carlos Dominguez as finance chief or to head the transport department. Dominguez was agriculture secretary in the cabinet of late President Corazon Aquino. He owns Marco Polo Hotel and is a childhood friend of Duterte.

“We’re looking for an administration that will have continuity -- almost seamless -- particularly in infrastructure,” John Forbes, senior adviser at the American Chamber of the Philippines, said in an interview with Bloomberg TV’s Haslinda Amin. “The first challenge is going to be infrastructure because the growth of the economy has produced much more demand on roads and airports and seaports.”

Once labeled Asia’s “sick man,” the nation of 101 million people has earned World Bank praise as the continent’s “rising tiger” under outgoing leader Aquino. It posted average annual growth of 6.2 percent over the past six years, the fastest pace since the 1970s.

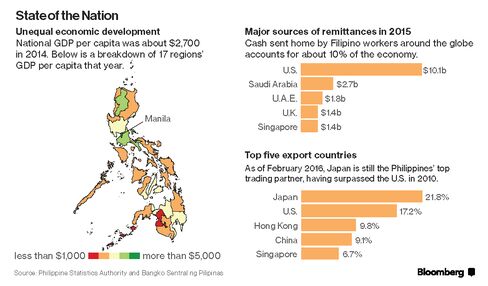

State of the Nation: The Philippines

Despite those gains, poverty rates remain high and Duterte tapped rising discontent among millions of voters who feel they haven’t benefited from Aquino’s reforms. Faster growth and 4 million jobs created during Aquino’s six-year term led to record car sales, but also clogged up Manila’s already gridlocked roads as infrastructure spending failed to keep pace with economic expansion.

Duterte has been making positive signals to investors. He told online news website Rappler in an interview published on Monday that he will consider raising the 40 percent foreign ownership limit in certain industries to win over investors. He also pledged to work with countries in the region to boost trade.

“The election outcome could turn out be a ‘sell the rumor and buy the news,’ ” said Michael Preiss, executive director for client investments at Taurus Wealth Advisors Pte. Ltd., a wealth management firm in Singapore. “Because Duterte has a reputation for strong leadership and establishing law and order, the country will benefit and investors will take notice and will start to vote with their money on the Philippines.”

Source: BLOOMBERG

Loading...